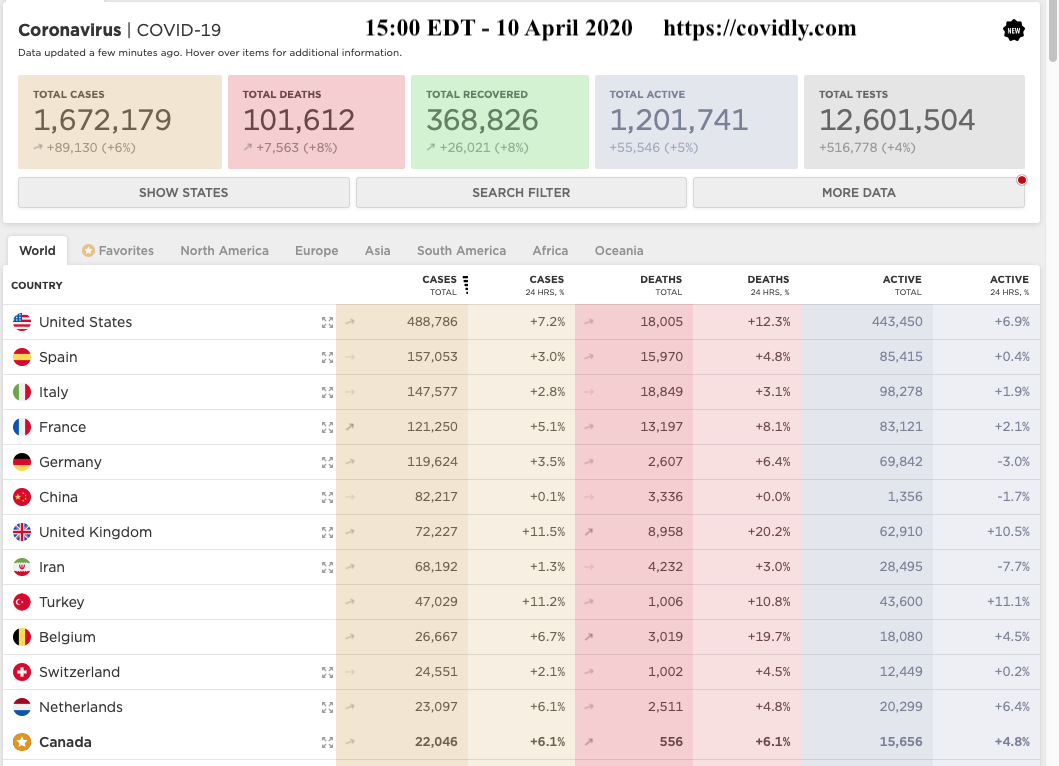

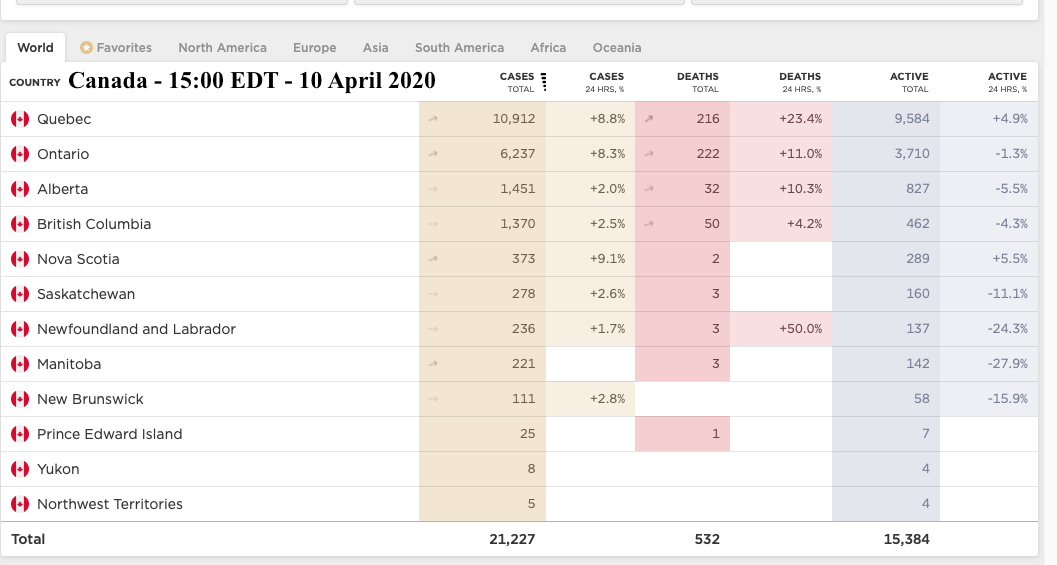

The number of cases of Covid-19 spreading around the world and increasing even more so in the United States of America.

Just one of U.S. President Donald Trump’s lies about Covid-19. The one that worries me the most.

When: Wednesday, March 11

The claim: In an Oval Office address, Trump said that private-health-insurance companies had “agreed to waive all co-payments for coronavirus treatments, extend insurance coverage to these treatments, and to prevent surprise medical billing.”

The truth: Insurers agreed only to absorb the cost of coronavirus testing—waiving co-pays and deductibles for getting the test. The Families First Coronavirus Response Act, the second coronavirus-relief bill passed by Congress, later mandated that COVID-19 testing be made free. The federal government has not required insurance companies to cover follow-up treatments, though some providers announced in late March that they will pay for treatments. The costs of other non-coronavirus testing or treatment incurred by patients who have COVID-19 or are trying to get a diagnosis aren’t waived either. And as for surprise medical billing? Mitigating it would require the cooperation of insurers, doctors, and hospitals. https://www.theatlantic.com/politics/archive/2020/04/trumps-lies-about-coronavirus/608647/

The number of American citizens who do not have access to, even affordable, healthcare is staggering. As the information below shows the United States does not have a full funded health care system that is available to all citizens. With the number of people who simply can not afford adequate health insurance I believe many will simply not apply to be tested and even some will not even seek medical attention if they do fully develop the disease. These people will then continue to infect others further exacerbating the pandemic.

The United States stands out from many other countries in not offering universal health insurance coverage. In 2010, 50 million people (16 percent of the U.S. population) were uninsured (DeNavas-Walt et al., 2011). Access to health care services, particularly in rural and frontier communities or disadvantaged urban centers, is often limited. The United States has a relatively weak foundation for primary care and a shortage of family physicians (American Academy of Family Physicians, 2009; Grumbach et al., 2009; Macinko et al., 2007; Sandy et al., 2009). Many Americans rely on emergency departments for acute, chronic, and even preventive care (Institute of Medicine, 2007a; Schoen et al., 2009b, 2011). Cost sharing is common in the United States, and high out-of-pocket expenses make health care services, pharmaceuticals, and medical supplies increasingly unaffordable (Commonwealth Fund Commission on a High Performance System, 2011; Karaca-Mandic et al., 2012). In 2011, one-third of American households reported problems paying medical bills (Cohen et al., 2012), a problem that seems to have worsened in recent years (Himmelstein et al., 2009). Health insurance premiums are consuming an increasing proportion of U.S. household income (Commonwealth Fund Commission on a High Performance System, 2011). (https://www.ncbi.nlm.nih.gov/books/NBK154484/)

An item from before The Affordable Care Act (ACA)

About 44 million people in this country have no health insurance, and another 38 million have inadequate health insurance. This means that nearly one-third of Americans face each day without the security of knowing that, if and when they need it, medical care is available to them and their families.

And then in 2019

Lack of health coverage has been a persistent problem in the U.S. The Affordable Care Act (ACA) sought to address gaps in the health coverage system and led to historic gains in health insurance coverage by extending Medicaid coverage to many low-income individuals and providing Marketplace subsidies for individuals below 400% of poverty. The number of uninsured non-elderly Americans decreased from over 46.5 million in 2010 (the year the ACA was enacted) to just below 27 million in 2016. However, for the second year in a row, the number of uninsured people increased from 2017 to 2018 by nearly 500,000 people. This issue brief describes how coverage has changed in recent years, examines the characteristics of the uninsured population, and summarizes the access and financial implications of not having coverage. (https://www.kff.org/uninsured/issue-brief/key-facts-about-the-uninsured-population/ Published: Dec 13, 2019)

The number of Americans without health insurance climbed to 27.5 million in 2018, according to federal data that show the first year-to-year increase in a decade, before the Affordable Care Act began reducing the ranks of the uninsured. (https://www.wsj.com/articles/number-of-americans-without-insurance-shows-first-increase-since2008-11568128381 April 10, 2020)

Health care seems to be such a problem in the U.S. that it is even counted on their annual census report.

In 2018, 8.5 percent of people, or 27.5 million, did not have health insurance at any point during the year. The uninsured rate and number of uninsured increased from 2017 (7.9 percent or 25.6 million).

• The percentage of uninsured children under the age of 19 increased by 0.6 percentage points between 2017 and 2018, to 5.5 percent.

• Between 2017 and 2018, the percentage of people without health insurance coverage at the time of interview decreased in three states and increased in eight states.

Not even all types of health care are covered:

In 2018, private health insurance coverage continued to be more prevalent than public coverage, covering 67.3 percent of the population and 34.4 percent of the population, respectively. Of the subtypes of health insurance coverage, employer-based insurance remained the most common, covering 55.1 percent of the population for all or part of the calendar year

(https://www.census.gov/library/publications/2019/demo/p60-267.html)

Insured persons from 2018Number of persons under age 65 uninsured at the time of interview: 30.1 million

Percent of persons under age 65 uninsured at the time of interview: 11.1%

Percent of children under age 18 uninsured at the time of interview: 5.2%

Percent of adults aged 18-64 uninsured at the time of interview: 13.3%

Percent of persons under age 65 with private insurance at time of interview: 65.1%

Percent of children under age 18 with private insurance at time of interview: 54.7%

Percent of adults aged 18-64 with private insurance at time of interview: 68.9%

Percent of persons under age 65 with public insurance at time of interview: 25.5%

Percent of children under age 18 with public insurance at time of interview: 41.8%

Percent of adults aged 18-64 with public insurance at time of interview: 19.4%

(Three tables from https://www.cdc.gov/nchs/fastats/health-insurance.htm)

Canada's health care system

"About Medicare

Medicare is a term that refers to Canada's publicly funded health care system. Instead of having a single national plan, we have 13 provincial and territorial health care insurance plans. Under this system, all Canadian residents have reasonable access to medically necessary hospital and physician services without paying out-of-pocket.

Roles and responsibilities for health care services are shared between provincial and territorial governments and the federal government.

The provincial and territorial governments are responsible for the management, organization and delivery of health care services for their residents.

Comprehensiveness The provincial and territorial plans must insure all medically necessary services provided by:

hospitals

physicians

dentists, when the service must be performed in a hospital Medically necessary services are not defined in the Canada Health Act. The provincial and territorial health care insurance plans consult with their respective physician colleges or groups. Together, they decide which services are medically necessary for health care insurance purposes.

If a service is considered medically necessary, the full cost must be covered by the public health care insurance plan.

Universality The provincial and territorial plans must cover all residents.

PortabilityThe provincial and territorial plans must cover all residents when they travel within Canada. Limited coverage is also required for travel outside the country.

When a resident moves to another province, they can continue to use their original health care insurance card for 3 months. This gives them enough time to register for the new plan and receive their new health insurance card."

(https://www.canada.ca/en/health-canada/services/canada-health-care-system.html)

In Ontario our health care insurance is provided by The Ontario Health Insurance Plan

"What services does OHIP cover?

The Ontario Health Insurance Plan (OHIP) pays for a wide range of health care services. It pays for most basic medical and emergency services. It can pay for all or part of the cost.

There are some services that OHIP does not pay for such as cosmetic surgery (dental or physical), dental services or chiropractic services.

For some treatments, OHIP pays part of the cost. For example:

Some services from your doctor, and podiatrists

Physiotherapy treatments

Dental services in hospitals

Eye tests

Travel costs: if you live in northern Ontario and must travel long distances for specialty medical care, OHIP may pay some travel costs.

What is covered under OHIP+?

OHIP+ covers many prescription medications for youths 24-years-old and under. You can find out if your medicines are covered through the online search tool. OHIP+ starts January 1, 2018."

(https://settlement.org/ontario/health/ohip-and-health-insurance/ontario-health-insurance-plan-ohip/what-services-does-ohip-cover/)

More comprehensive information can be found at:

(http://www.health.gov.on.ca/en/common/system/default.aspx)

Yes, I also have private insurance which is provided by Government Service Medical Insurance Plan (GSMIP) through payroll, now pension deduction. When I was working for the government I was required to have this. While in Canada I was only required to have the minimum coverage (Level II) which would provide for some services not covered by OHIP. When I was posted overseas where my Provincial plan would not cover any medical expenses I was required to increase the coverage to Level III. This was coverage covered all expenses which occurred overseas, including doctor, hospital, and any other costs such as hotels and meals. Upon return to Canada I had the option of reverting back to Level II or maintaining the Level III coverage. In Canada the added coverage provides for a semi-private hospital room and added prescription coverage.

While we say that our provincial health coverage is free it really isn't. After all nothing is free in this world. Different Provinces have different ways of collecting the funds not provided by the Federal Government. In Ontario it is now an employers responsibly to pay the monthly OHIP fee. In other Provinces it may be through added sales tax, or a specific tax on gasoline, or user pay through payroll deductions. No matter how the fee is collected it appears as if we do not directly pay, consequently the general idea is free because when we walk out of the doctor's office or hospital we do not have to reach into our pocket before we leave or dread a bill demanding payment.

Just one of U.S. President Donald Trump’s lies about Covid-19. The one that worries me the most.

When: Wednesday, March 11

The claim: In an Oval Office address, Trump said that private-health-insurance companies had “agreed to waive all co-payments for coronavirus treatments, extend insurance coverage to these treatments, and to prevent surprise medical billing.”

The truth: Insurers agreed only to absorb the cost of coronavirus testing—waiving co-pays and deductibles for getting the test. The Families First Coronavirus Response Act, the second coronavirus-relief bill passed by Congress, later mandated that COVID-19 testing be made free. The federal government has not required insurance companies to cover follow-up treatments, though some providers announced in late March that they will pay for treatments. The costs of other non-coronavirus testing or treatment incurred by patients who have COVID-19 or are trying to get a diagnosis aren’t waived either. And as for surprise medical billing? Mitigating it would require the cooperation of insurers, doctors, and hospitals. https://www.theatlantic.com/politics/archive/2020/04/trumps-lies-about-coronavirus/608647/

The number of American citizens who do not have access to, even affordable, healthcare is staggering. As the information below shows the United States does not have a full funded health care system that is available to all citizens. With the number of people who simply can not afford adequate health insurance I believe many will simply not apply to be tested and even some will not even seek medical attention if they do fully develop the disease. These people will then continue to infect others further exacerbating the pandemic.

The United States stands out from many other countries in not offering universal health insurance coverage. In 2010, 50 million people (16 percent of the U.S. population) were uninsured (DeNavas-Walt et al., 2011). Access to health care services, particularly in rural and frontier communities or disadvantaged urban centers, is often limited. The United States has a relatively weak foundation for primary care and a shortage of family physicians (American Academy of Family Physicians, 2009; Grumbach et al., 2009; Macinko et al., 2007; Sandy et al., 2009). Many Americans rely on emergency departments for acute, chronic, and even preventive care (Institute of Medicine, 2007a; Schoen et al., 2009b, 2011). Cost sharing is common in the United States, and high out-of-pocket expenses make health care services, pharmaceuticals, and medical supplies increasingly unaffordable (Commonwealth Fund Commission on a High Performance System, 2011; Karaca-Mandic et al., 2012). In 2011, one-third of American households reported problems paying medical bills (Cohen et al., 2012), a problem that seems to have worsened in recent years (Himmelstein et al., 2009). Health insurance premiums are consuming an increasing proportion of U.S. household income (Commonwealth Fund Commission on a High Performance System, 2011). (https://www.ncbi.nlm.nih.gov/books/NBK154484/)

An item from before The Affordable Care Act (ACA)

About 44 million people in this country have no health insurance, and another 38 million have inadequate health insurance. This means that nearly one-third of Americans face each day without the security of knowing that, if and when they need it, medical care is available to them and their families.

And then in 2019

Lack of health coverage has been a persistent problem in the U.S. The Affordable Care Act (ACA) sought to address gaps in the health coverage system and led to historic gains in health insurance coverage by extending Medicaid coverage to many low-income individuals and providing Marketplace subsidies for individuals below 400% of poverty. The number of uninsured non-elderly Americans decreased from over 46.5 million in 2010 (the year the ACA was enacted) to just below 27 million in 2016. However, for the second year in a row, the number of uninsured people increased from 2017 to 2018 by nearly 500,000 people. This issue brief describes how coverage has changed in recent years, examines the characteristics of the uninsured population, and summarizes the access and financial implications of not having coverage. (https://www.kff.org/uninsured/issue-brief/key-facts-about-the-uninsured-population/ Published: Dec 13, 2019)

The number of Americans without health insurance climbed to 27.5 million in 2018, according to federal data that show the first year-to-year increase in a decade, before the Affordable Care Act began reducing the ranks of the uninsured. (https://www.wsj.com/articles/number-of-americans-without-insurance-shows-first-increase-since2008-11568128381 April 10, 2020)

Health care seems to be such a problem in the U.S. that it is even counted on their annual census report.

In 2018, 8.5 percent of people, or 27.5 million, did not have health insurance at any point during the year. The uninsured rate and number of uninsured increased from 2017 (7.9 percent or 25.6 million).

• The percentage of uninsured children under the age of 19 increased by 0.6 percentage points between 2017 and 2018, to 5.5 percent.

• Between 2017 and 2018, the percentage of people without health insurance coverage at the time of interview decreased in three states and increased in eight states.

Not even all types of health care are covered:

In 2018, private health insurance coverage continued to be more prevalent than public coverage, covering 67.3 percent of the population and 34.4 percent of the population, respectively. Of the subtypes of health insurance coverage, employer-based insurance remained the most common, covering 55.1 percent of the population for all or part of the calendar year

(https://www.census.gov/library/publications/2019/demo/p60-267.html)

Insured persons from 2018Number of persons under age 65 uninsured at the time of interview: 30.1 million

Percent of persons under age 65 uninsured at the time of interview: 11.1%

Percent of children under age 18 uninsured at the time of interview: 5.2%

Percent of adults aged 18-64 uninsured at the time of interview: 13.3%

Percent of persons under age 65 with private insurance at time of interview: 65.1%

Percent of children under age 18 with private insurance at time of interview: 54.7%

Percent of adults aged 18-64 with private insurance at time of interview: 68.9%

Percent of persons under age 65 with public insurance at time of interview: 25.5%

Percent of children under age 18 with public insurance at time of interview: 41.8%

Percent of adults aged 18-64 with public insurance at time of interview: 19.4%

(Three tables from https://www.cdc.gov/nchs/fastats/health-insurance.htm)

Canada's health care system

"About Medicare

Medicare is a term that refers to Canada's publicly funded health care system. Instead of having a single national plan, we have 13 provincial and territorial health care insurance plans. Under this system, all Canadian residents have reasonable access to medically necessary hospital and physician services without paying out-of-pocket.

Roles and responsibilities for health care services are shared between provincial and territorial governments and the federal government.

The provincial and territorial governments are responsible for the management, organization and delivery of health care services for their residents.

Comprehensiveness The provincial and territorial plans must insure all medically necessary services provided by:

hospitals

physicians

dentists, when the service must be performed in a hospital Medically necessary services are not defined in the Canada Health Act. The provincial and territorial health care insurance plans consult with their respective physician colleges or groups. Together, they decide which services are medically necessary for health care insurance purposes.

If a service is considered medically necessary, the full cost must be covered by the public health care insurance plan.

Universality The provincial and territorial plans must cover all residents.

PortabilityThe provincial and territorial plans must cover all residents when they travel within Canada. Limited coverage is also required for travel outside the country.

When a resident moves to another province, they can continue to use their original health care insurance card for 3 months. This gives them enough time to register for the new plan and receive their new health insurance card."

(https://www.canada.ca/en/health-canada/services/canada-health-care-system.html)

In Ontario our health care insurance is provided by The Ontario Health Insurance Plan

"What services does OHIP cover?

The Ontario Health Insurance Plan (OHIP) pays for a wide range of health care services. It pays for most basic medical and emergency services. It can pay for all or part of the cost.

There are some services that OHIP does not pay for such as cosmetic surgery (dental or physical), dental services or chiropractic services.

For some treatments, OHIP pays part of the cost. For example:

Some services from your doctor, and podiatrists

Physiotherapy treatments

Dental services in hospitals

Eye tests

Travel costs: if you live in northern Ontario and must travel long distances for specialty medical care, OHIP may pay some travel costs.

What is covered under OHIP+?

OHIP+ covers many prescription medications for youths 24-years-old and under. You can find out if your medicines are covered through the online search tool. OHIP+ starts January 1, 2018."

(https://settlement.org/ontario/health/ohip-and-health-insurance/ontario-health-insurance-plan-ohip/what-services-does-ohip-cover/)

More comprehensive information can be found at:

(http://www.health.gov.on.ca/en/common/system/default.aspx)

Yes, I also have private insurance which is provided by Government Service Medical Insurance Plan (GSMIP) through payroll, now pension deduction. When I was working for the government I was required to have this. While in Canada I was only required to have the minimum coverage (Level II) which would provide for some services not covered by OHIP. When I was posted overseas where my Provincial plan would not cover any medical expenses I was required to increase the coverage to Level III. This was coverage covered all expenses which occurred overseas, including doctor, hospital, and any other costs such as hotels and meals. Upon return to Canada I had the option of reverting back to Level II or maintaining the Level III coverage. In Canada the added coverage provides for a semi-private hospital room and added prescription coverage.

While we say that our provincial health coverage is free it really isn't. After all nothing is free in this world. Different Provinces have different ways of collecting the funds not provided by the Federal Government. In Ontario it is now an employers responsibly to pay the monthly OHIP fee. In other Provinces it may be through added sales tax, or a specific tax on gasoline, or user pay through payroll deductions. No matter how the fee is collected it appears as if we do not directly pay, consequently the general idea is free because when we walk out of the doctor's office or hospital we do not have to reach into our pocket before we leave or dread a bill demanding payment.

RSS Feed

RSS Feed